If you’re thinking about trying online trading, you’ve come across Plus500. It’s one of the most popular platforms for trading CFDs — short for “Contracts for Difference.”

If you’re thinking about trying online trading, you’ve come across Plus500. It’s one of the most popular platforms for trading CFDs — short for “Contracts for Difference.”

But is it any good?

Is this platform beginner’s friendly?

Is Plus500 a trustworthy broker?

In this honest Plus500 review, we’ll walk you through everything — the platform, its features, the fees, and what real users say about it.

No hype. No hard sell. Just the facts in plain language so you can decide if Plus500 is right for you.

✅ What Is Plus500?

Plus500 is a global CFD trading platform where you can trade price movements without owning the actual asset.

That means:

- You don’t buy a stock or crypto.

- You speculate on whether the price goes up or down.

- If your guess is right, you make a profit. If not, you lose money.

Founded in 2008, Plus500 is now listed on the London Stock Exchange and is regulated in many countries.

Here’s what you can trade on Plus500:

Here’s what you can trade on Plus500:

- Forex (currency pairs like EUR/USD, GBP/JPY)

- Stocks (Apple, Amazon, Tesla)

- Indices (S&P 500, FTSE 100)

- Commodities (Gold, Oil, Natural Gas)

- ETFs (Exchange-Traded Funds)

- Options (limited set)

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin, CFDs)

Everything is handled through CFDs — so you’re always trading on price differences, not owning the assets.

Is Plus500 Trusted and Legit?

Yes, Plus500 is a legit and regulated broker.

They are authorized by top financial regulators, including:

- FCA – UK Financial Conduct Authority

- CySEC(#250/14) – Cyprus Securities and Exchange Commission

- ASIC – Australian Securities & Investments Commission

- FMA – Financial Markets Authority (New Zealand)

They hold clients’ funds in segregated bank accounts also provide negative balance protection which is a regulatory requirement. Meaning you can’t lose more than you deposit.

However, you should know:

82% of retail traders lose money when trading CFDs with Plus500.

That’s not because Plus500 is shady — it’s because CFD trading is risky by nature.

If you’re not sure how it works, start with a demo account to get the feel for it.

What Is the Plus500 Demo Account?

The Plus500 demo account is a free, no-risk version of the platform.

You get to:

- Trade with virtual money

- Use real-time prices

- Try all the features

- Practice without stress

It’s unlimited — there’s no expiry.

It is one of the best ways to:

- Learn how the platform works

- Test strategies before using real money

- Avoid mistakes when you’re starting out

You don’t even need to verify your ID to try the demo. Just sign up with your email and start.

Try the Plus500 demo account here

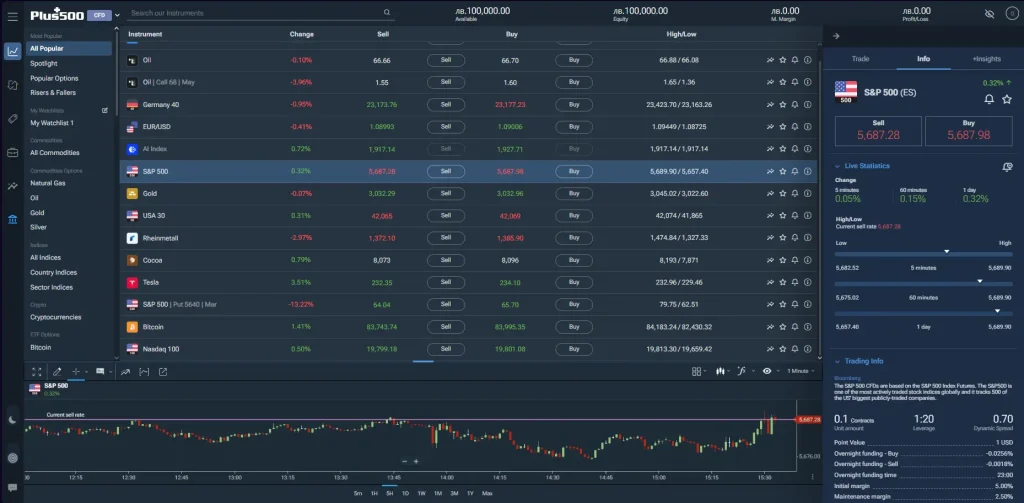

How Is Plus500 Platform?

CFDs are “complex financial products” that require experience and knowledge.

The Plus500 platform is designed for everyday users — not just finance pros.

Here’s what you’ll see:

- Clean dashboard

- Customizable watchlists

- Interactive price charts

- Option to set stop loss, take profit, and alerts

Plus500 works in your web browser and also has mobile apps for iOS and Android.

You don’t need to install anything.

Even if you’ve never traded before, you’ll get the hang of it quickly. The learning curve is gentle, especially with the demo account.

Click here to open your free Plus500 demo account

Disclaimer: “82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.”

How Does Plus500 Make Money?

Instead of charging commissions, Plus500 earns money through the spread — that’s the small difference between the buy and sell price.

There are some other small fees to know about:

- Overnight fees (if you keep trades open after market hours)

- Currency conversion fees (if your trade is in a different currency)

- Inactivity fee ($10/month after 3 months of no login)

All fees are clearly shown before you open a position.

There’s no deposit fee, and no commission per trade.

Trust & Reliability

Is Plus500 a reliable place to trade? Yes, it is — but you still need to be careful.

Plus500 is a regulated broker. It’s licensed by major financial authorities like the FCA (UK), CySEC (EU), ASIC (Australia), and more. That means it has to follow strict rules to protect customers.

Your money is kept in segregated accounts, separate from the company’s funds. It adds a layer of protection.

You also get negative balance protection, so you can’t lose more than you deposit. That’s helpful if a trade moves against you suddenly.

But keep in mind: CFDs are risky. The company is safe, but trading is not. According to their data, 82% of retail traders lose money on their platform.

So yes — Plus500 is legit. But it’s up to you to trade responsibly.

Commissions and Fees

Plus500 doesn’t charge trading commissions — but there are a few fees to watch out for.

You pay through the spread, which is the small difference between the buy and sell price of an asset. This is how most CFD platforms make money. Spreads are competitive and clearly shown before you trade.

Other fees include:

- Overnight funding (if you hold positions past market close)

- Currency conversion (if you trade in a currency different from your account)

- Inactivity fee ($10/month if you don’t log in for 3 months)

The full list of fees relevant to Plus500 can be found at https://www.plus500.com.cy/en/Help/FeesCharges

There are no deposit or withdrawal fees from Plus500’s side. But your bank or payment provider may charge something on their end.

Overall, the fee structure is simple and transparent. Just make sure you read the fine print before trading.

Account Types

Plus500 has just one main account type for most users.

Unlike some brokers that offer multiple account tiers, Plus500 offers:

- Retail account (standard account for everyday traders)

- Professional account (available only if you qualify under certain rules)

With a retail account, you get:

- Access to all tradable assets

- Risk warnings and leverage limits to protect you

- Negative balance protection

- Free demo account

The professional account has higher leverage, but you lose some of the protections that retail users get. The professional account users do not have access to ICF right. It’s meant for experienced traders only.

There’s no social trading, copy trading, or Islamic (swap-free) accounts. So if you’re looking for those, this may not be your ideal broker.

Click here to open your free Plus500 demo account

Disclaimer: “82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.”

Deposits & Withdrawals

Plus500 makes it easy to add and withdraw money — and there are no hidden charges from their side.

You can fund your account using:

- Credit or debit cards (Visa, MasterCard)

- Bank transfer

- PayPal

- Skrill (in some countries)

- Apple Pay (in supported regions)

Minimum deposit is usually $100, but it may vary depending on your country or method.

Withdrawals are also simple. Just go to the Funds section and request a payout. Processing usually takes 1–3 business days, depending on the method.

Plus500 doesn’t charge withdrawal fees, but banks or e-wallets might, especially with currency conversion.

Make sure your account is verified (ID and address) before you request a withdrawal to avoid delays.

What Payment Methods Are Supported?

You can fund your Plus500 account using:

- Credit/debit cards (Visa, MasterCard)

- PayPal

- Skrill

- Bank transfer

- Apple Pay (in some regions)

Minimum deposit: usually $100

Minimum trade size: varies per instrument

Withdrawals are free and processed within 1–3 business days.

What Tools and Features Does Plus500 Offer?

While Plus500 comes with several useful features:

Technical Tools

- Real-time price charts

- Dozens of indicators like RSI, MACD, and Bollinger Bands

- Multi-timeframe analysis

Risk Management Tools

- Stop Loss / Take Profit

- Guaranteed Stop (at extra cost)

- Price alerts and notifications

Mobile Trading

- Full-featured mobile apps

- Real-time push notifications

- Syncs with web version

Educational Tools

- FAQs and basic guides

- Economic calendar

- No live webinars or deep courses (so you’ll need to learn elsewhere)

What Is Customer Support Like?

Plus500 offers 24/7 customer support through:

- Live chat (within the platform)

There’s no phone support.

Response times are usually fast via chat. But some users say replies can feel copy-paste-ish during busy hours.

Still, for most general questions, it gets the job done.

Who Should Use Plus500?

Good for:

- New traders who want a clean, easy interface

- People who want to trade on mobile

- Anyone who wants a free demo account with real-time prices

- Traders who prefer low-cost trading (no commissions)

Not great for:

- Long-term investors (since you don’t own assets)

- People looking for advanced tools like MetaTrader

- Those who want deep educational content or personal coaching

Real User Reviews

Plus500 has thousands of reviews online.

On Trustpilot, it scores 4.1 out of 5, with comments like:

- “Great for beginners.”

- “Easy to use.”

- “Quick withdrawals.”

Negative reviews usually come from users who didn’t fully understand the risks of CFD trading. That’s why education and demo practice are so important.

Pros and Cons of Plus500

Here’s a quick breakdown:

Pros

- Free demo account (no time limit)

- Beginner-friendly interface

- No trading commissions

- Works on web and mobile

Cons

- CFDs only — no real assets

- Limited educational tools

- No phone support

- An inactivity fee if you stop using it

Summary: Is Plus500 Right for You?

If you want a reliable way to start trading CFDs, Plus500 is a solid option.

You can test everything with a demo account, get used to the tools, and trade real markets without using real money.

It’s not overloaded with advanced tools, but it covers all the basics well. And if you’re ready to go live, you can switch to a real account in minutes.

Just remember: CFD trading is risky. Take time to learn. Never trade more than you can afford to lose.

Tip: Try the Plus500 Demo First

Still unsure? Try the Plus500 demo account for free. You don’t need to deposit anything. Just log in and practice trading using virtual funds. It’s the easiest way to see if the platform fits your trading style.

Click here to open your free Plus500 demo account

Disclaimer: “82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.”

Final Thoughts on This Plus500 Review

To sum it up, Plus500 is a solid choice for anyone looking to trade CFDs on a simple, easy-to-use platform. It’s fully regulated, offers a free unlimited demo account, and charges no commissions — spreads. While it may not have the advanced tools some pros want, it’s great for beginners who want to learn the ropes without getting overwhelmed. As this Plus500 review shows, the platform is reliable, fast, and straightforward — but always remember, CFD trading comes with risk. If you’re just getting started, the demo account is the smartest way to begin.